Shoppers shift away from brand loyalty amid economic pressure and deal-driven buying

Consumers across the United States are increasingly prioritizing value over brand loyalty, fueling a sharp rise in private label purchases and reshaping how consumer packaged goods companies compete at retail. According to Ibotta Inc.’s newly released 2026 State of Spend report, value has become the dominant force guiding shopping behavior, even as inflation concerns show early signs of easing.

The report, based on nationwide online surveys, reveals that shoppers are becoming more flexible, more deal-driven, and more open to store brands than at any point in recent years. For CPG manufacturers and retailers alike, the findings point to a fundamental shift in how consumers evaluate price, quality, and brand relevance.

Value Becomes the New Center of Consumer Decision-Making

Ibotta’s research shows that 62 percent of consumers now prioritize affordability over brand names, underscoring a broad move away from traditional brand loyalty. While 67 percent of consumers still report being negatively impacted by inflation, that figure is down three percentage points from 2025, suggesting shoppers are adapting to prolonged economic uncertainty rather than waiting for conditions to normalize.

“The data confirms a critical shift,” said Chris Riedy, chief revenue officer at Ibotta. “Value isn’t just a trend anymore. It’s the center of gravity for the American consumer.”

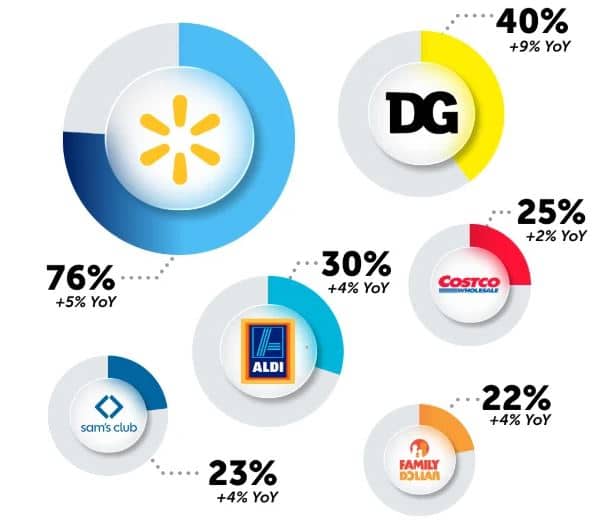

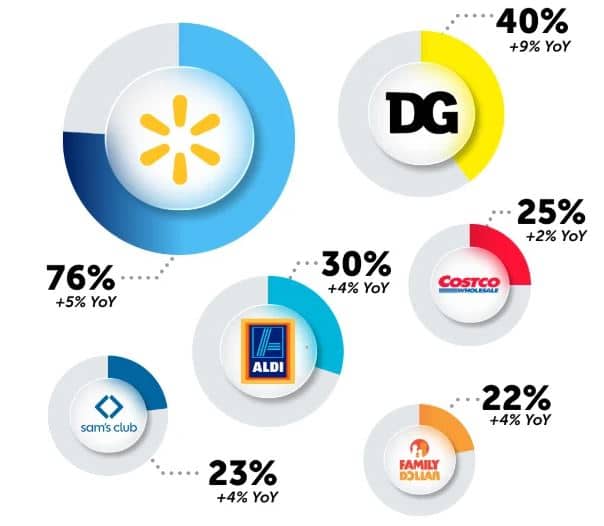

As shoppers recalibrate spending habits, value-focused retailers such as Walmart and Dollar General continue to gain traction. Consumers are increasingly choosing stores where low prices and promotions outweigh brand familiarity, forcing manufacturers to rethink how they engage customers at the shelf.

Grocery Shopping Becomes Less Planned and More Opportunistic

One of the report’s most notable findings is the decline in planned grocery shopping. Only 68 percent of consumers now make a grocery list before shopping, down from 75 percent in 2023. Meanwhile, 32 percent of shoppers enter stores with only a loose idea of what they want, creating more opportunities for impulse purchases driven by in-store promotions.

This shift toward flexible shopping behavior benefits retailers and brands that can deliver timely, relevant offers at the point of decision. According to Ibotta, shoppers who browse without a fixed list are more likely to switch products when discounts or incentives are available.

Discounts Drive Trial, but Repeat Purchases Still Dominate

Despite growing openness to new brands, most consumer purchases remain familiar. The report found that only 26 percent of items bought are unfamiliar products, highlighting the challenge brands face when trying to drive trial.

Price incentives play a decisive role in overcoming that barrier. Among food shoppers, 62 percent require a discount of at least 25 percent to try a new brand. Beverage shoppers show similar sensitivity, with 52 percent willing to switch brands for an offer of up to 25 percent off.

The data suggests that while consumers are cautious, targeted promotions remain an effective tool for influencing behavior, especially when shoppers are already primed to seek value.

Private Label Products See Strong Momentum

As price sensitivity increases, private label brands are emerging as clear winners. Ibotta’s report shows a 44 percent increase in consumers choosing store brands over national brands compared with 2025, signaling a rapid shift in perception.

Only 38 percent of consumers now believe name brands offer higher quality, down six percentage points year over year. At the same time, 88 percent of shoppers say they plan to maintain or increase their private label purchases, reinforcing the long-term nature of this trend.

For retailers, private label growth represents both a margin opportunity and a loyalty driver. For national brands, it raises the stakes around differentiation, innovation, and value communication.

Health-Focused Products Still Command Willingness to Spend

While value dominates purchasing decisions, the report shows that consumers are not purely price-driven. Shoppers remain willing to pay more for products that align with personal health goals.

According to the findings:

- 51 percent of food shoppers are interested in better-for-you products

- 46 percent of beverage shoppers show similar interest

This indicates that functional benefits, clean labels, and health-forward positioning can still justify premium pricing, even in a value-conscious environment.

What the Data Means for Brands and Retailers

The 2026 State of Spend report highlights a consumer who is more strategic, less brand-loyal, and highly responsive to relevant offers. Success in this environment requires brands to meet shoppers where they are, whether through personalized promotions, competitive pricing, or compelling value propositions.

For CPG companies, the message is clear. Winning shelf space is no longer enough. Brands must earn attention at the moment of purchase by delivering value that resonates with today’s economically aware consumer.